40 what is a coupon payment on a bond

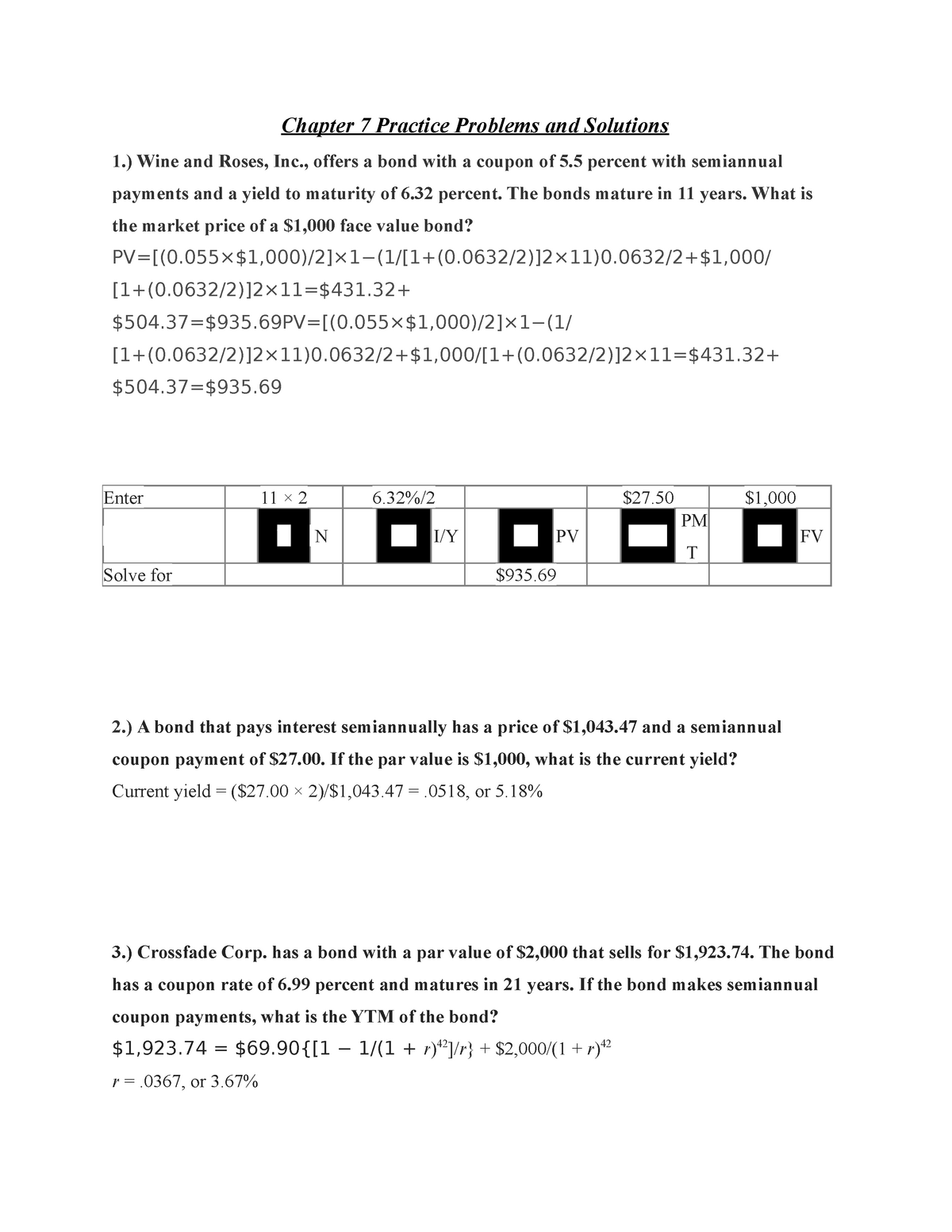

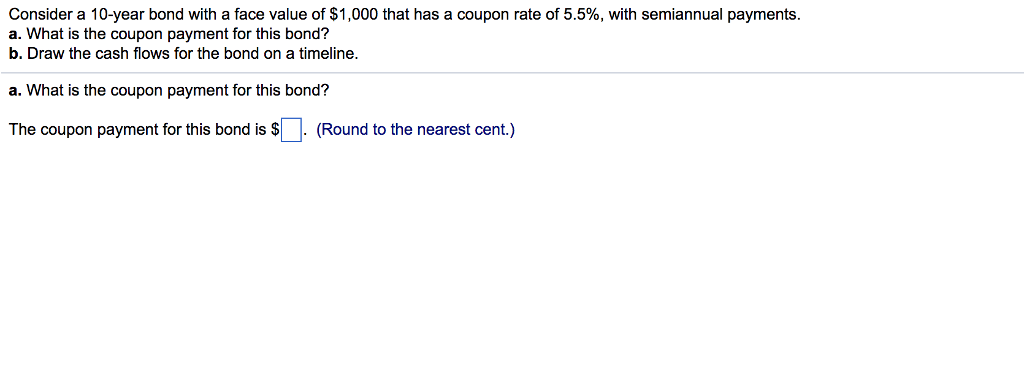

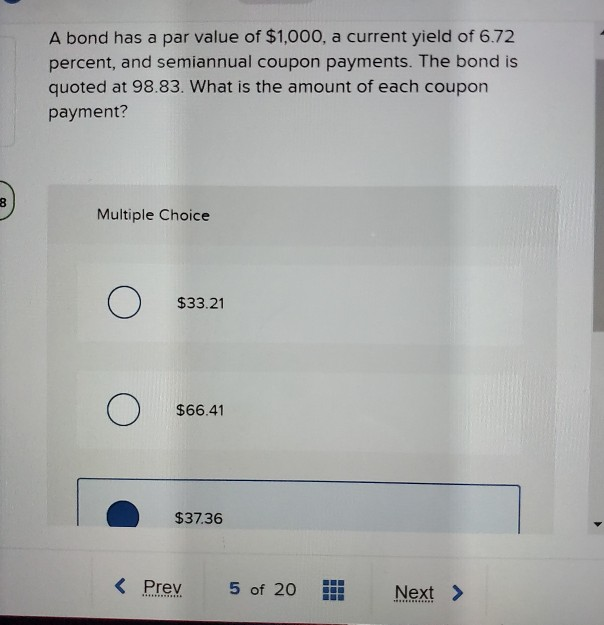

Bond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction. How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

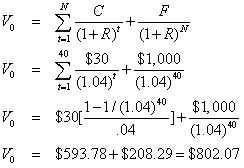

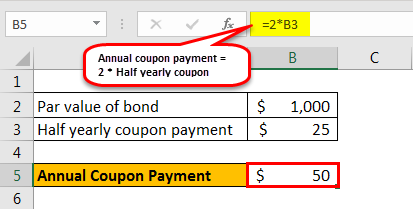

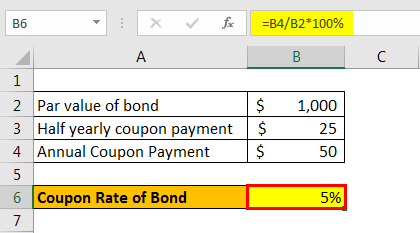

Coupon Bond Formula | Examples with Excel Template - EDUCBA The term "coupon" refers to the periodic interest payment received by bondholders and bonds that make such payments are known as coupon bonds. Typically, the coupon is expressed as a percentage of the par value of the bond. The formula for coupon bond means price determination of the bond that pays coupon and it is done by discounting the ...

What is a coupon payment on a bond

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. What Is a Bond Coupon, and How Is It Calculated? - Investopedia 2.4.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

What is a coupon payment on a bond. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · A bond's current yield, however, is different: a percentage based on the coupon payment divided by the bond's price, it represents the bond's effective return. Coupon Interest Rate vs. Yield . What is a Coupon Payment? - Definition | Meaning | Example Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond. Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The coupon payment represents the return generated by the bond and it is paid by the issuer of the bond. Mostly bonds are issued for a specified purpose, and the cash flow from that specific operation is then used by the issuer to service the coupon payments of the bond.

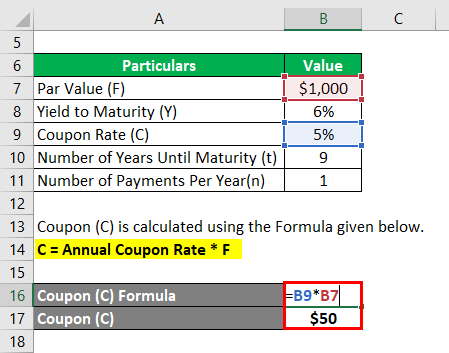

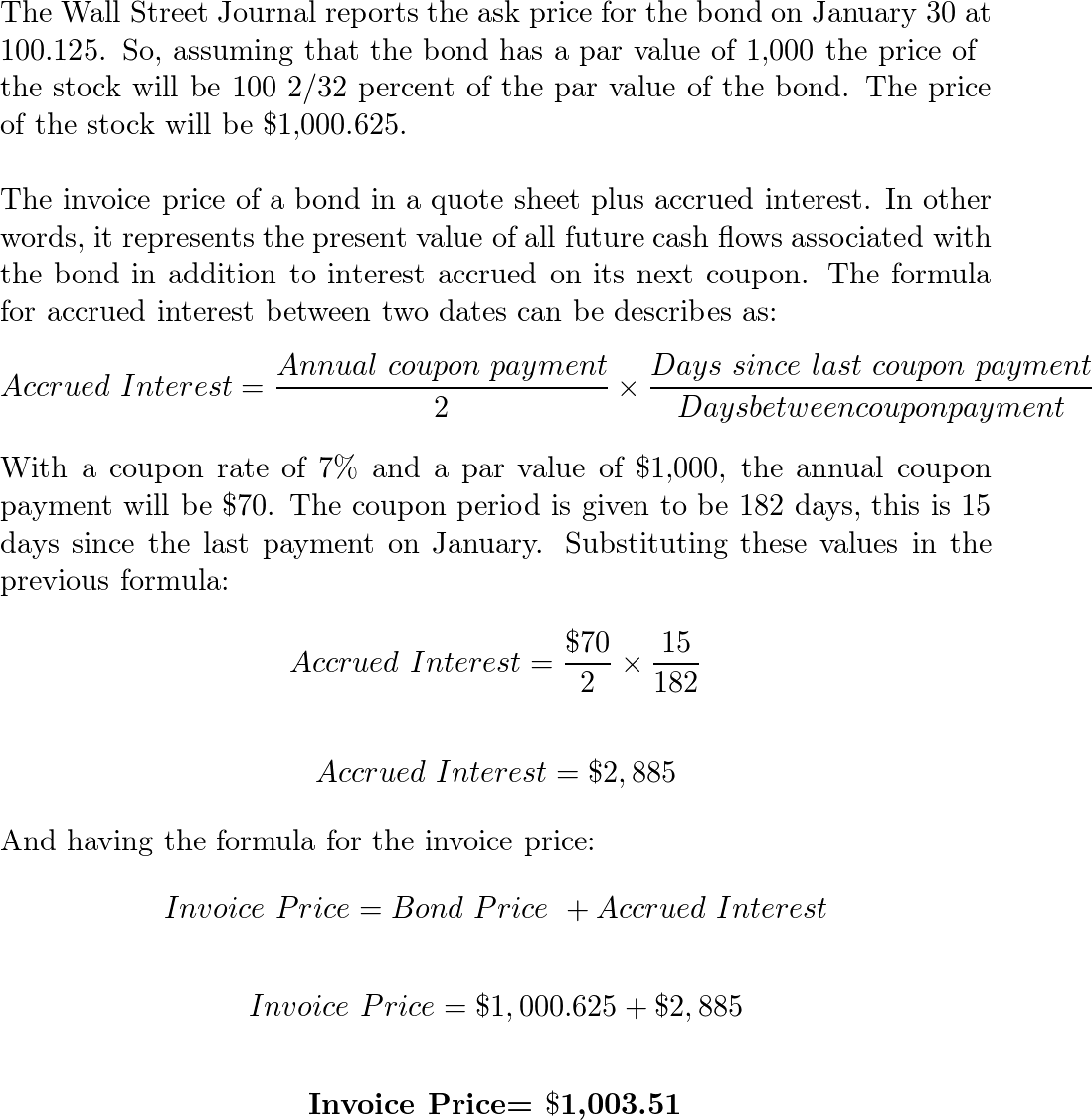

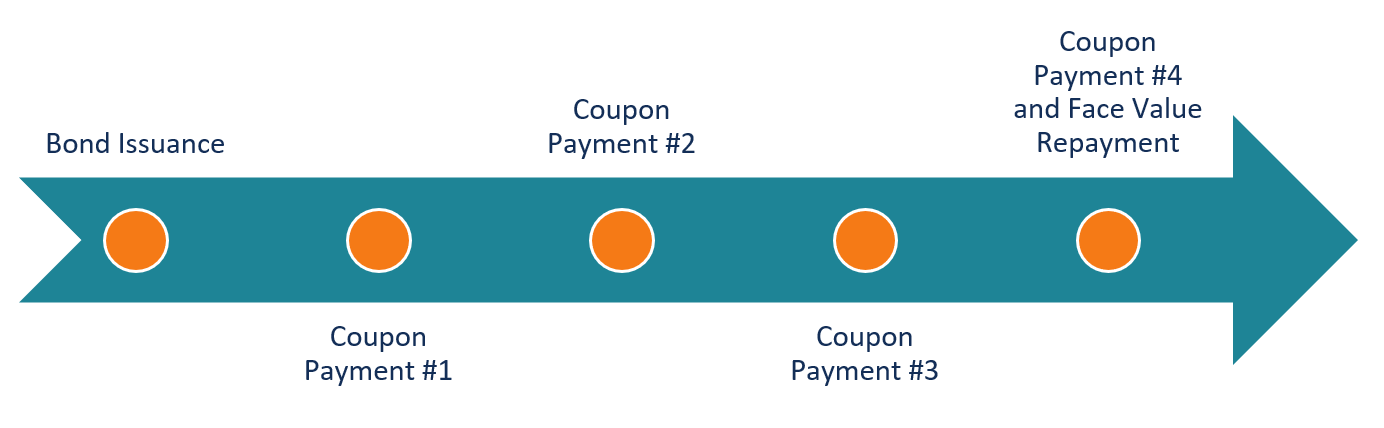

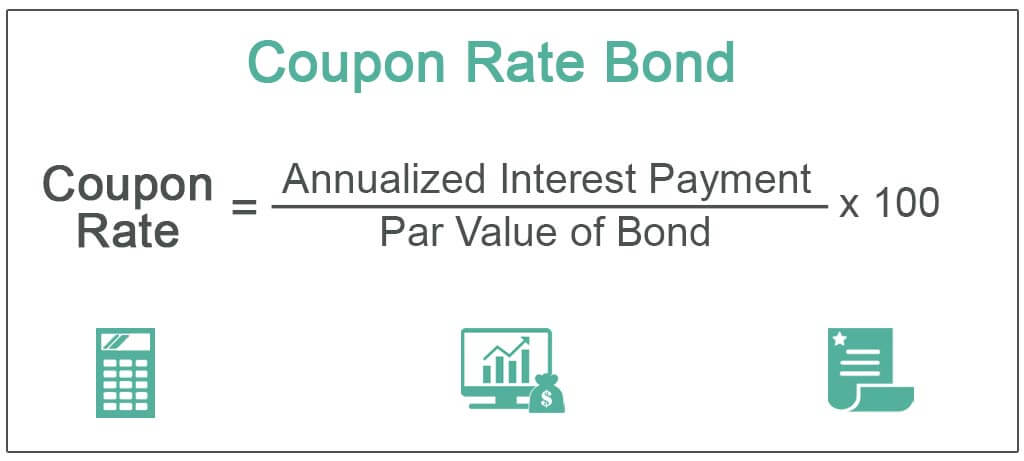

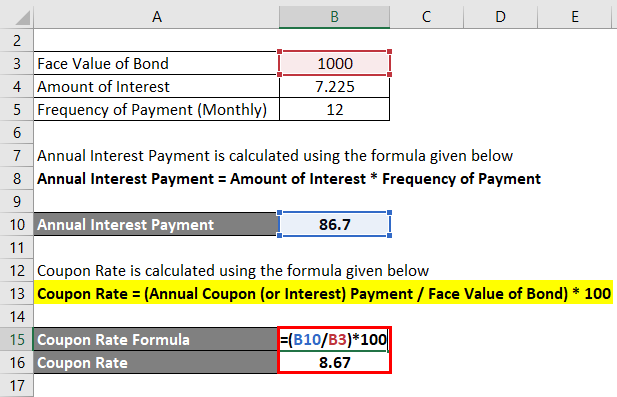

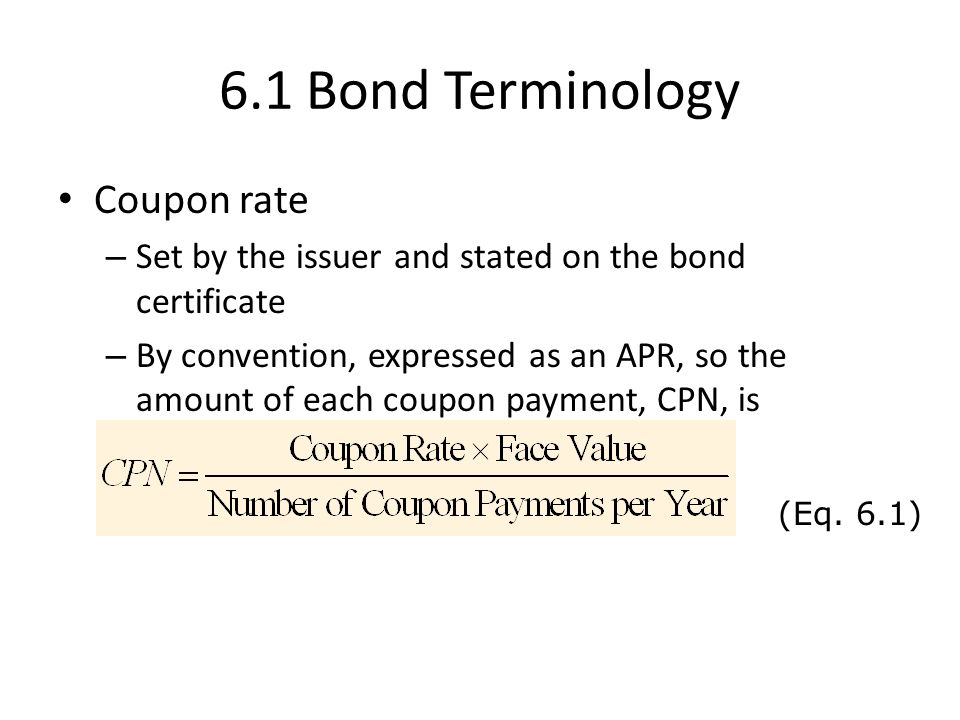

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The steps to calculate the coupon rate of a bond are the following: Firstly, the face value or par value of the bond issuance is determined as per the funding requirement of the company. Now, the number of interest paid during the year is determined, and then the annualized interest payment is calculated by adding up all the payments during the ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds … Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Coupon Payment | Definition, Formula, Calculator & Example 27.4.2019 · A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, …

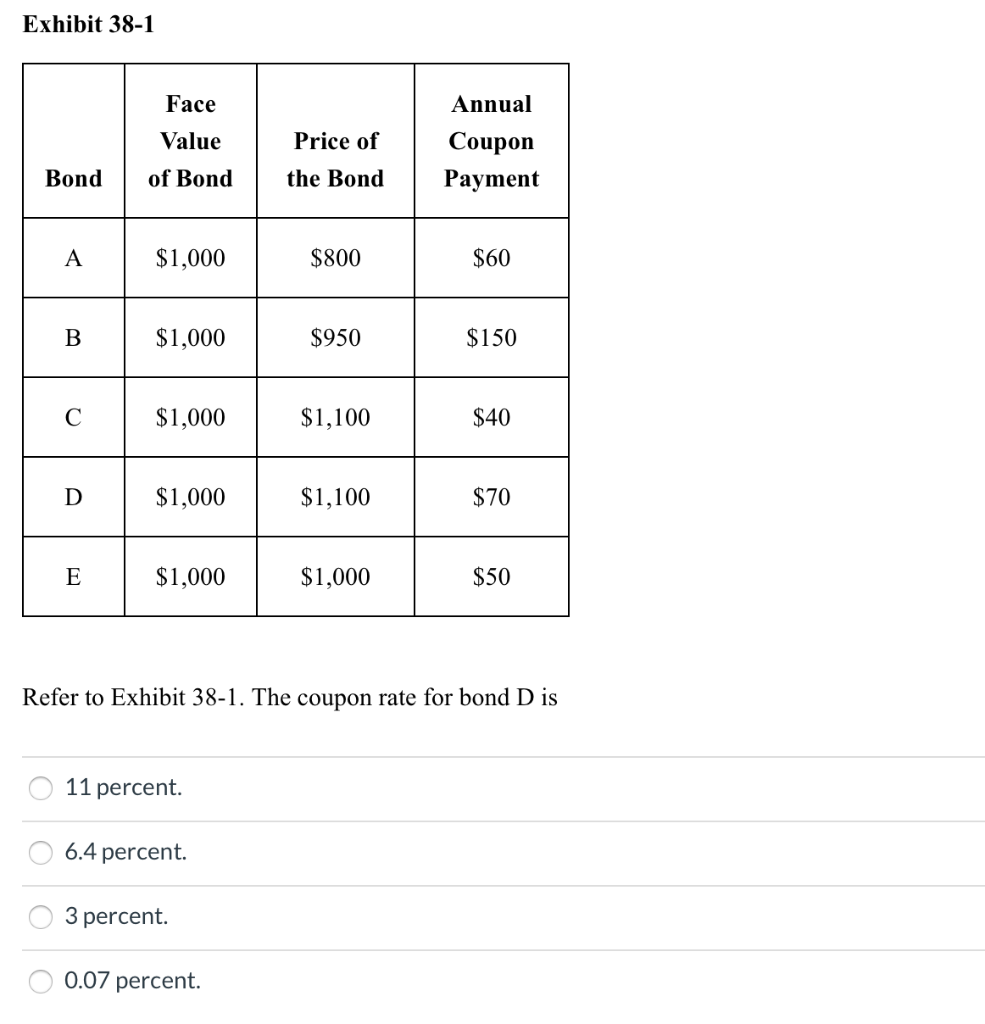

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Bond Coupon Payments. A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year ... Coupon Bond: Definition, How They Work, Example, and Use Today A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are... What is coupon bond or coupon payment? | Invest Carrier A coupon bond or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from the issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a year divided by the face value of the bond in question). How To Find Coupon Rate Of A Bond On Financial Calculator For example, you have a $1,000 bond with a $50 coupon payment. To calculate the coupon rate, you would divide $50 by $1,000 and multiply by 100. The result is 5%, which means the bond pays 5% interest per year. Conclusion. After reading this guide, you should know how to calculate a bond's coupon rate on a financial calculator.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Note

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Payment | Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value.

What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates.

What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

Coupon Rate Definition - Investopedia 28.5.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

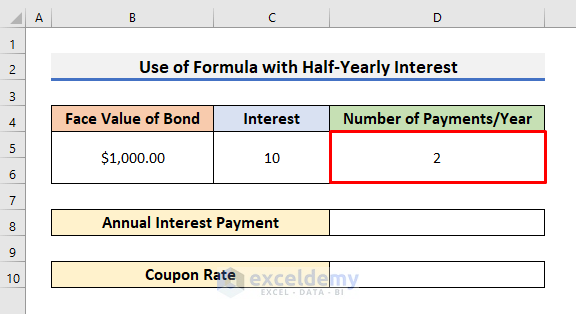

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual ...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.

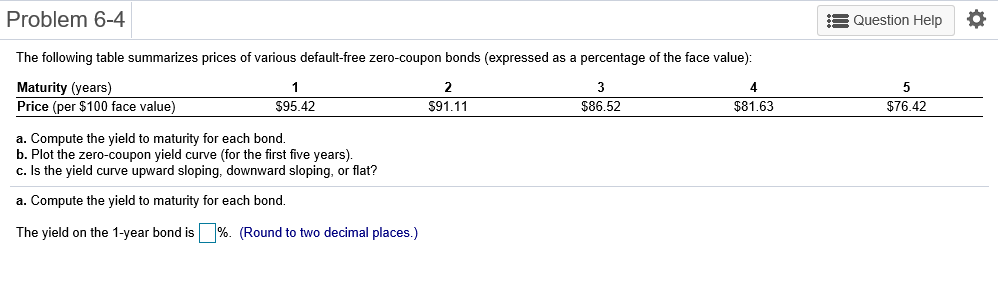

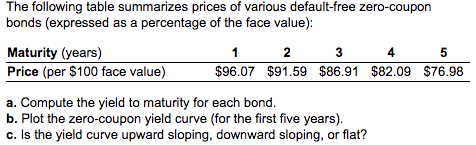

› terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, …

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it.

› Calculate-an-Interest-Payment-onHow to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. For example, you may see a 5% coupon on a bond with a face value of $1000. In this case, the coupon would be $50 (0.05 multiplied by $1000). It is important to remember the coupon is always an annual ...

Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

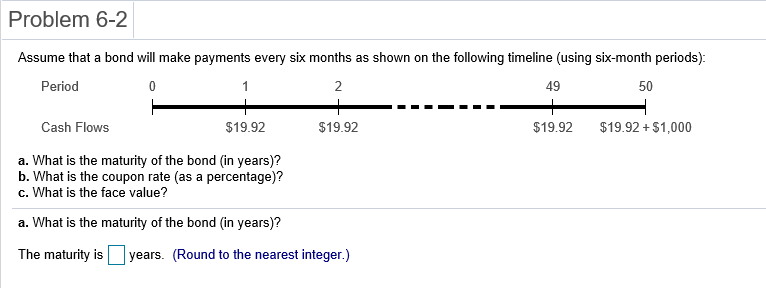

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid.

What is the coupon payment of a bond with a face value of $5000 ... - Quora Answer (1 of 3): The concept of interest in connection with a bond is at best ambiguous, but more strictly, meaningless. Interest is the charge for the use of borrowed money. You lend a borrower $5000 and they pay you i% interest for the use of it until they pay it back. A bond issuer, however, u...

Coupon (Bonds) - Explained - The Business Professor, LLC A coupon is the amount an investor receives for each acquired bond depending on the percentage initially associated with it. For instance, a bond with a face value of $5000 at 4% interest yield per annum will pay a coupon of $200 yearly and $100 per coupon payment since it is done semi-annually.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase price of the bond, its nominal return over its duration & its yield to maturity. Entering Years: For longer duration bonds enter the number of years to maturity.

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value.

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

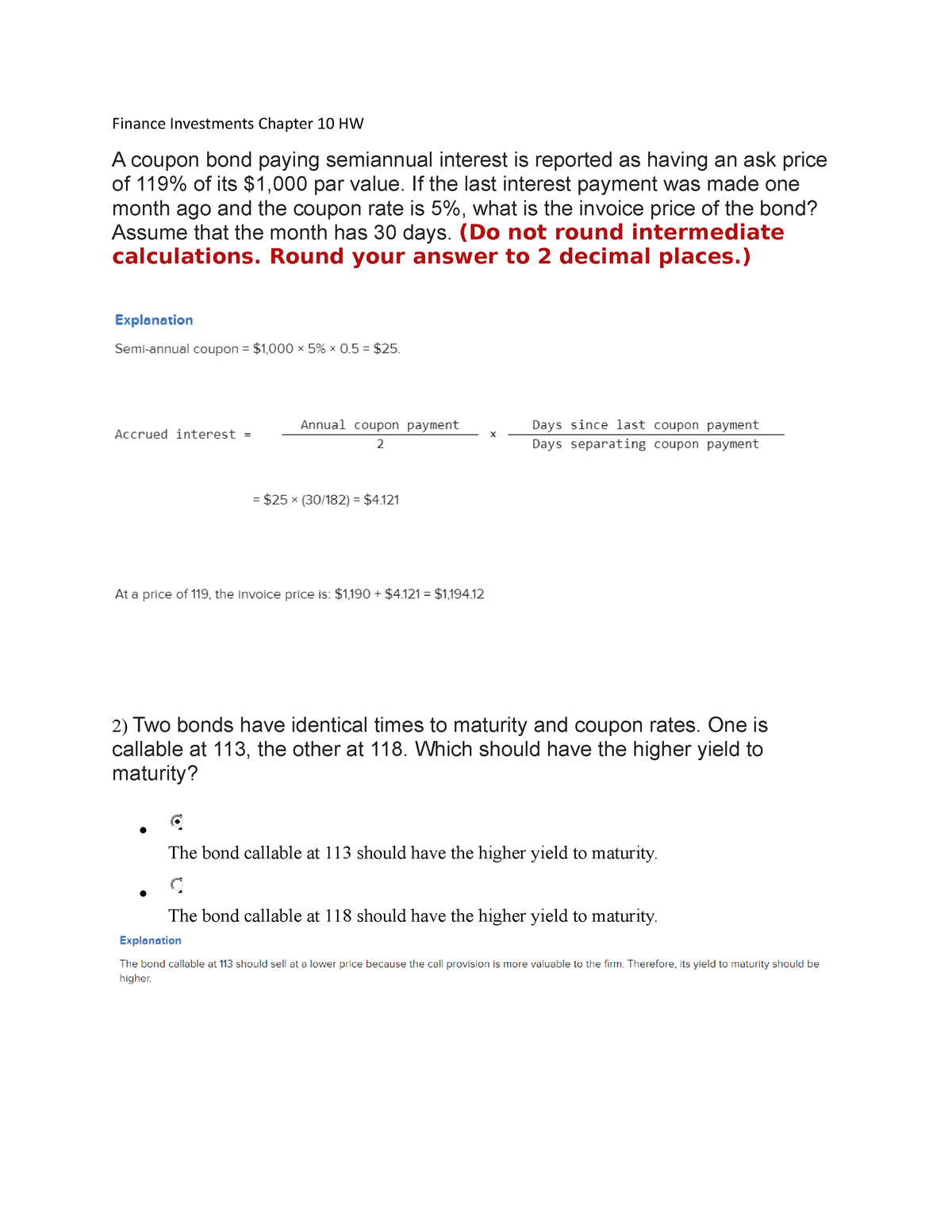

What Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

Coupon Bond: Definition, How They Work, Example, and Use Today 31.3.2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.

Coupon Types - Financial Edge There is a special type of fixed-rate bond called a zero-coupon bond. In this case, there is no interest payment between the issuance of the bond and maturity. So, they "pay" a fixed coupon of 0%. This does not mean that there is no return for bondholders, as zero-coupon bonds are usually sold at a discounted price but repaid at 100% at ...

What is coupon on bonds? - moneycontrol.com Coupon rate is calculated by taking the annual coupon payment and dividing it by the bond's face value. For instance, if you have a 10-year bonds worth Rs 5,000 having a coupon rate of 10%, then ...

Coupon Bond - Definition, Terminologies, Why Invest? - WallStreetMojo The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond's nominal value and the period factor. For example, if you own a bond with a face value of $1,000 and an annual coupon rate of 5%, your annual interest payment will be $5.

› dictionary › bondBond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction.

Coupon Bond - Guide, Examples, How Coupon Bonds Work Updated October 13, 2022 What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

What Is a Bond Coupon, and How Is It Calculated? - Investopedia 2.4.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Post a Comment for "40 what is a coupon payment on a bond"