38 yield to maturity for zero coupon bond

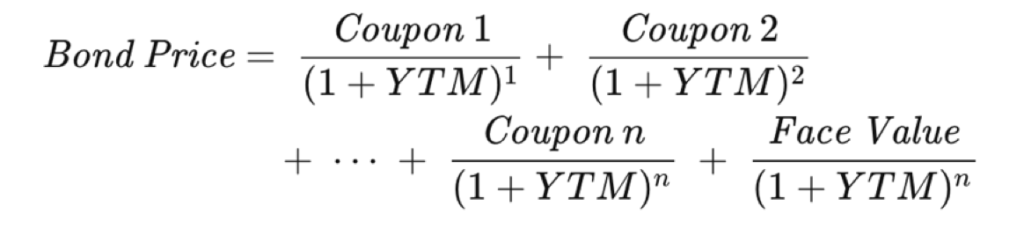

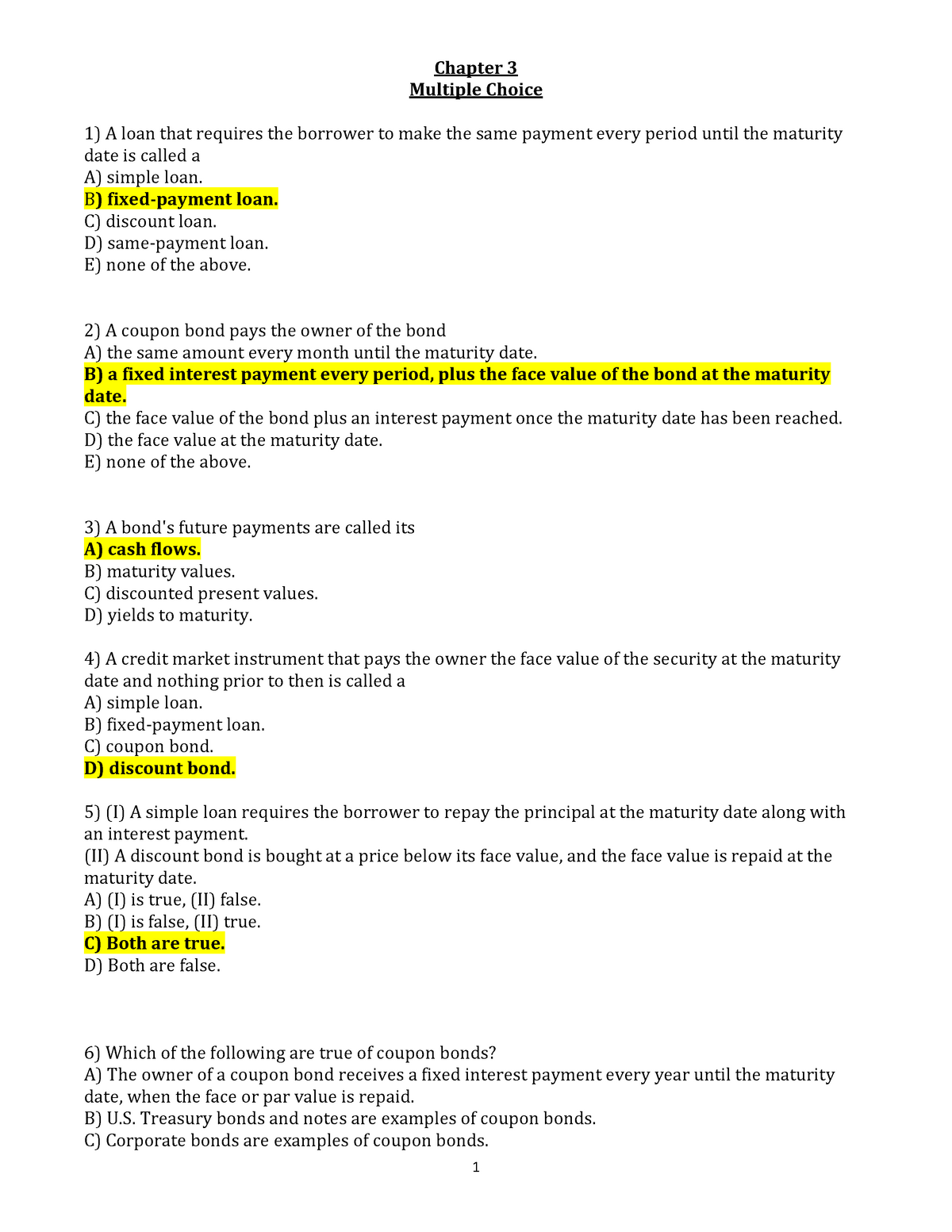

21. The yield-to-maturity of an 8-year zero coupon bond, The yield-to-maturity of an 8-year zero coupon bond, with a par value of $1,000 and a market price of $700, is - Answered by a verified Business Tutor ... Suppose you purchase a 30 -year, zero-coupon bond with a yield to maturity of 6.1 %. You hold the bond for five years before selling it. a. The stated yield to maturity and realized compound yield to | Quizlet Zero-coupon bonds do not have reoccurring interest payments. As the bonds have zero coupons, these periodic payments cannot be reinvested and capitalized on the value of the bond until its maturity or sale. For this reason the compound yield of the bond will not vary. Therefore, the stated yield to maturity and the realized compound yield to ...

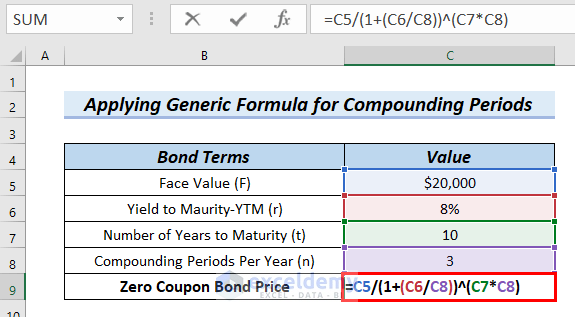

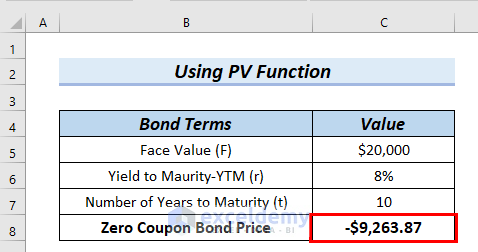

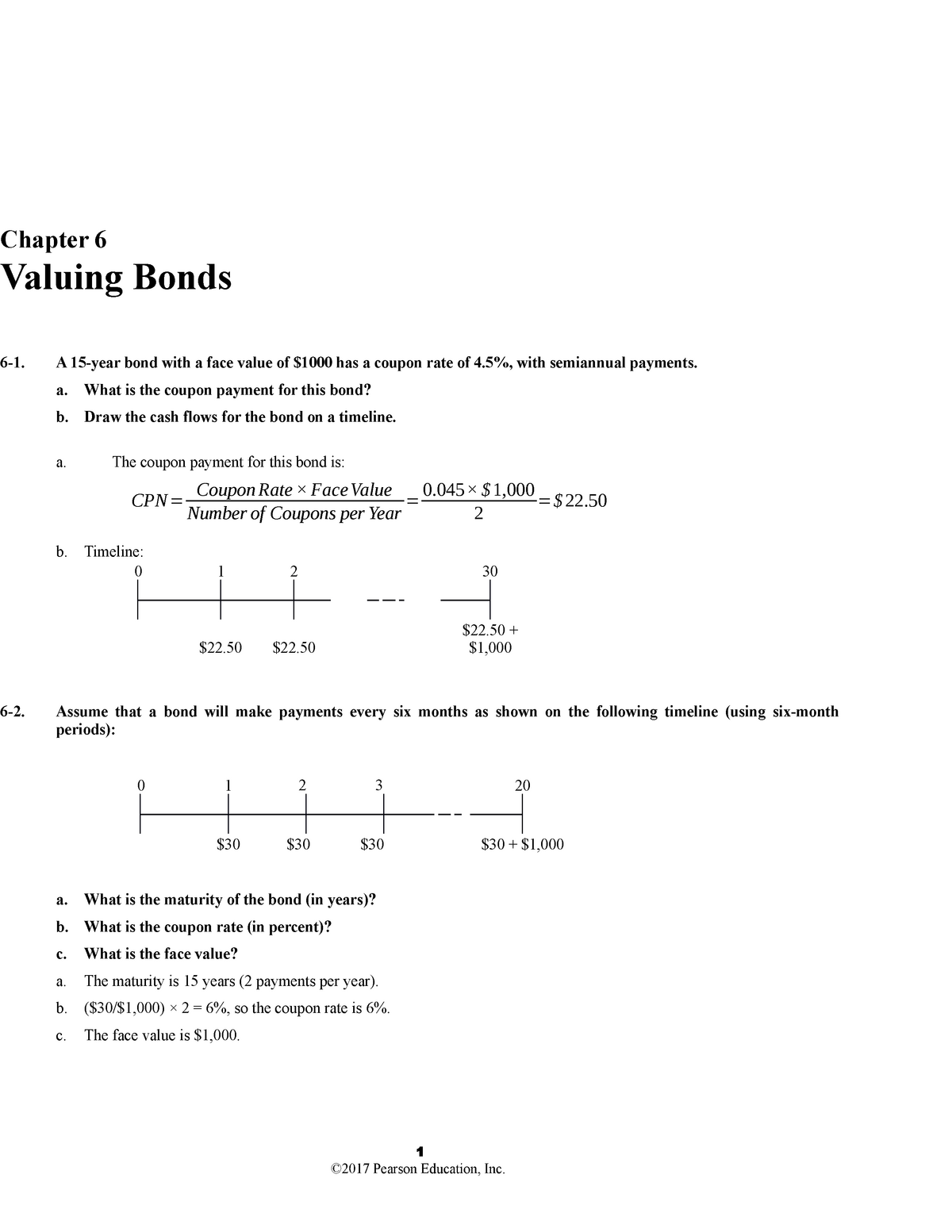

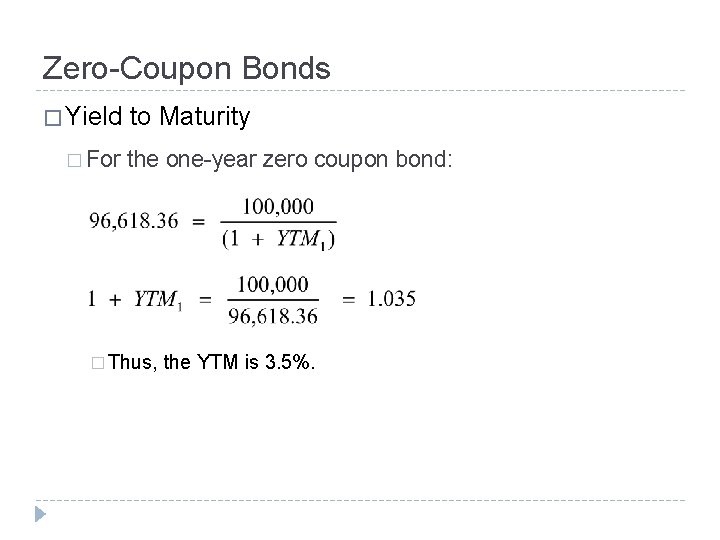

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Yield to maturity for zero coupon bond

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20. open source hwid spoofer - iel.okitei.info The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. The required yield to maturity is close to 6%. At 5.865% the price of the bond is INR 950.02. Hence, the estimated yield to maturity for this bond is 5.865%. Variations of Yield to Maturity (YTM) Yield to Call.

Yield to maturity for zero coupon bond. Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com = $5,317 This gain of $5,317 is made up of the unwinding of discount (the increase in present value as it nears maturity) plus capital gain portion that results from positive movement in market yield on the bond. The value of zero-coupon bond will continue to increase till it reach $100,000 at the time of its maturity. What is the yield to maturity (YTM) of a zero coupon bond with a face ... Both of them have coupon rate equal to 5%. The first one with 5.10% Yield to maturity and matures in 10 years and the second with 5.95% Yield to maturity and matures in 8 years. lower Would I buy it any Continue Reading Quora User Retired University Professor Author has 19.3K answers and 9.9M answer views 1 y Related Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can ...

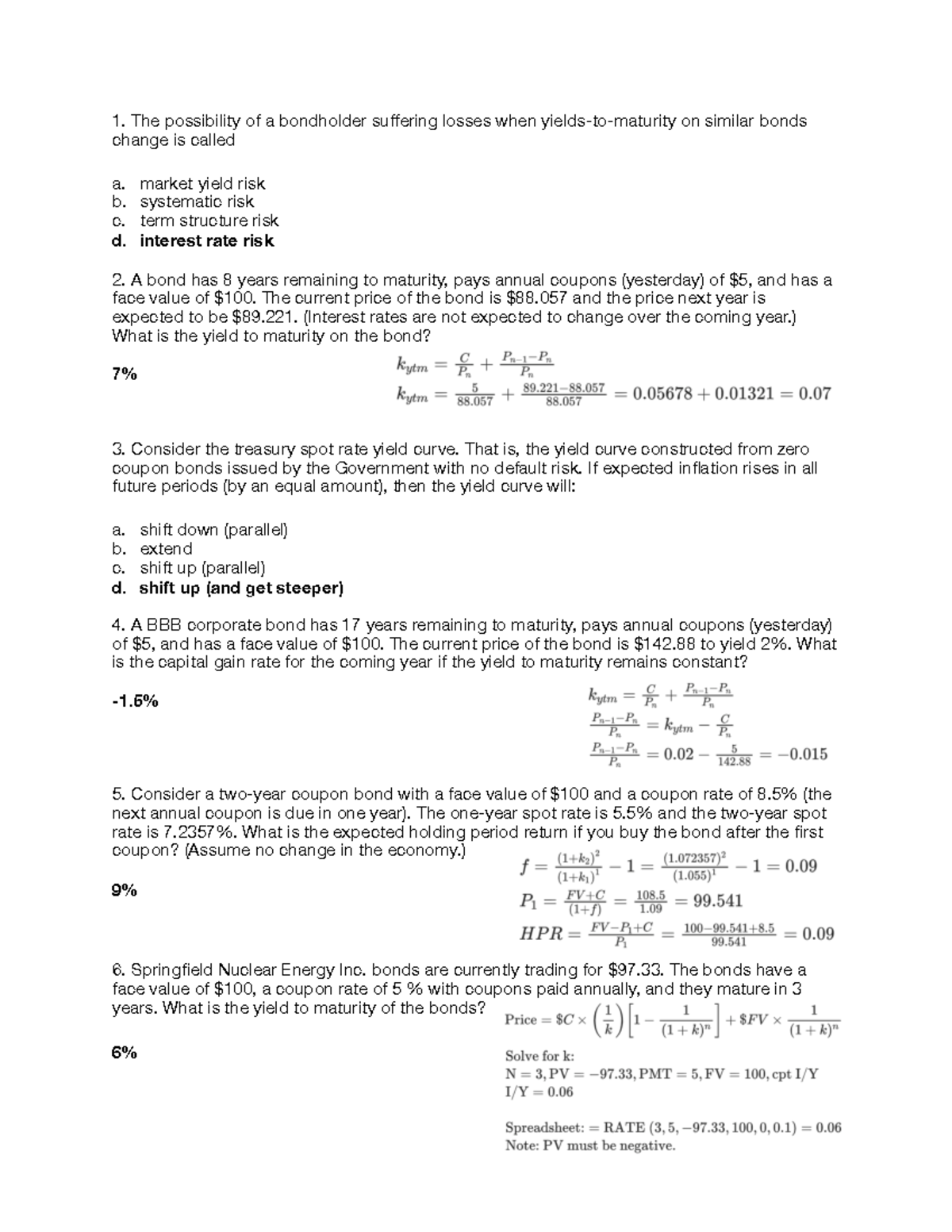

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Bond maturity value calculator - vnzs.okitei.info The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to- Maturity and Yield-to-Call on Bonds . Bond Price Field - The Price of the bond is calculated or entered in this field. Enter amount in negative value . ... usps retroactive pay 2022 nrlca ryobi 80v zero turn mower price. Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Yield to maturity is an essential investing concept used to compare bonds of different coupons and times until maturity. Without accounting for any interest payments, zero-coupon bonds always...

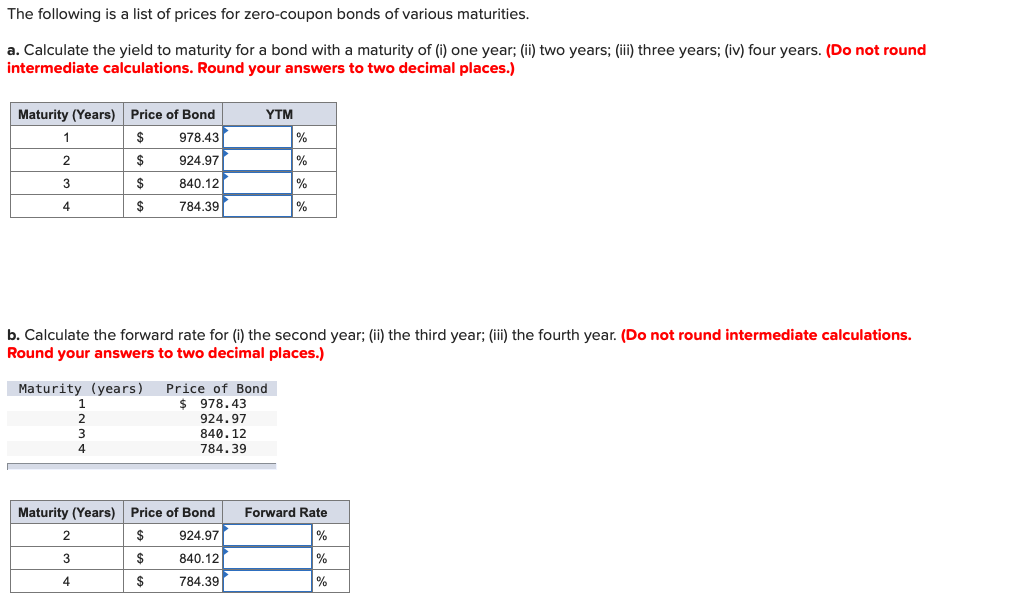

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Solved The yield to maturity on one-year zero-coupon bonds - Chegg The yield to maturity on one-year zero-coupon bonds is 7.3%. The yield to maturity on two-year zero-coupon bonds is 8.3%. What is the forward rate of interest for the second year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) YIELDS TO MATURITY ON ZERO-COUPON RONDS - Ebrary Its yield to maturity is 5.174% (s.a.). The assumption of two periods in the year, while totally arbitrary, is common in financial markets because the yield on the zero then can be compared directly to yields to maturity on traditional semiannual payment fixed- income bonds. Solved The yield to maturity on one-year zero-coupon bonds | Chegg.com The yield to maturity on one-year zero-coupon bonds is 8.4%. The yield to maturity on two-year zero-coupon bonds is 9.4%. a. What is the forward rate of interest for the second year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Forward rate of interest % b. If you believe in the expectations hypothesis ...

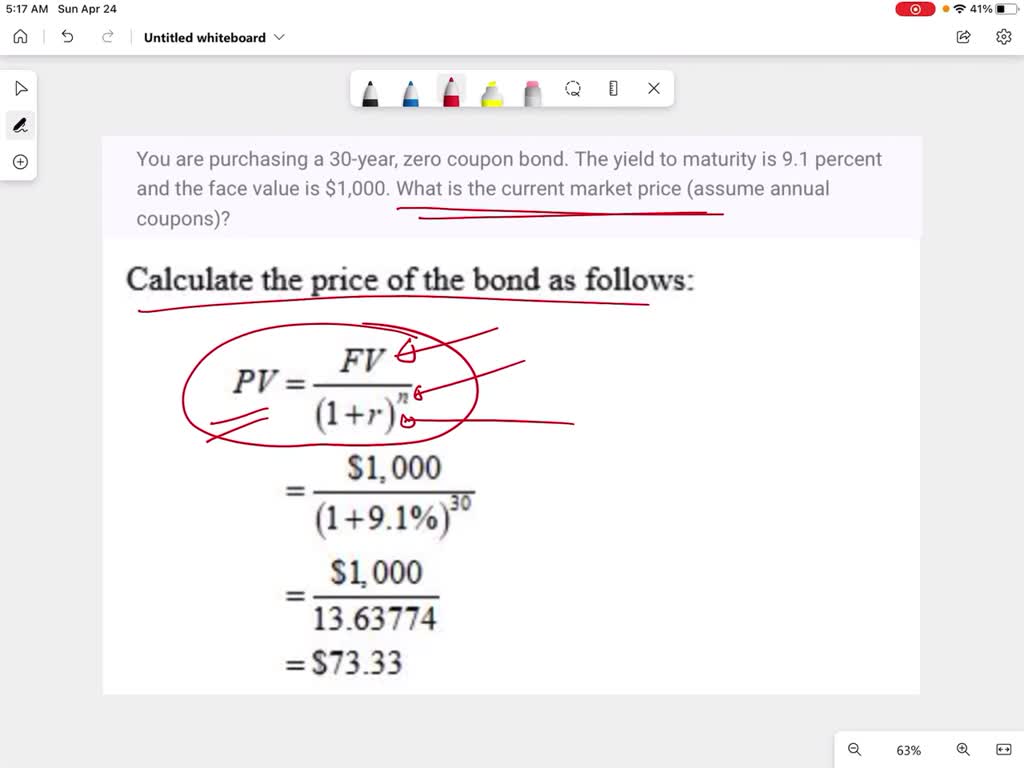

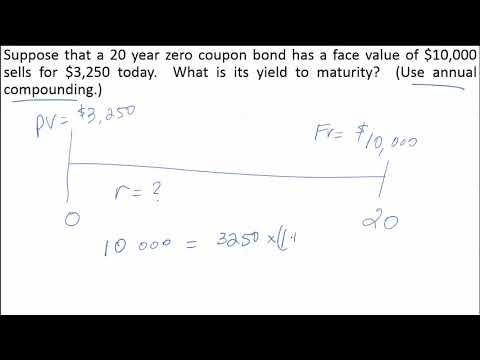

you are purchasing a 30 year zero coupon bond the yield to maturity is 91 percent and the face value is 1000 what is the current market price assume annual coupons 34097

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

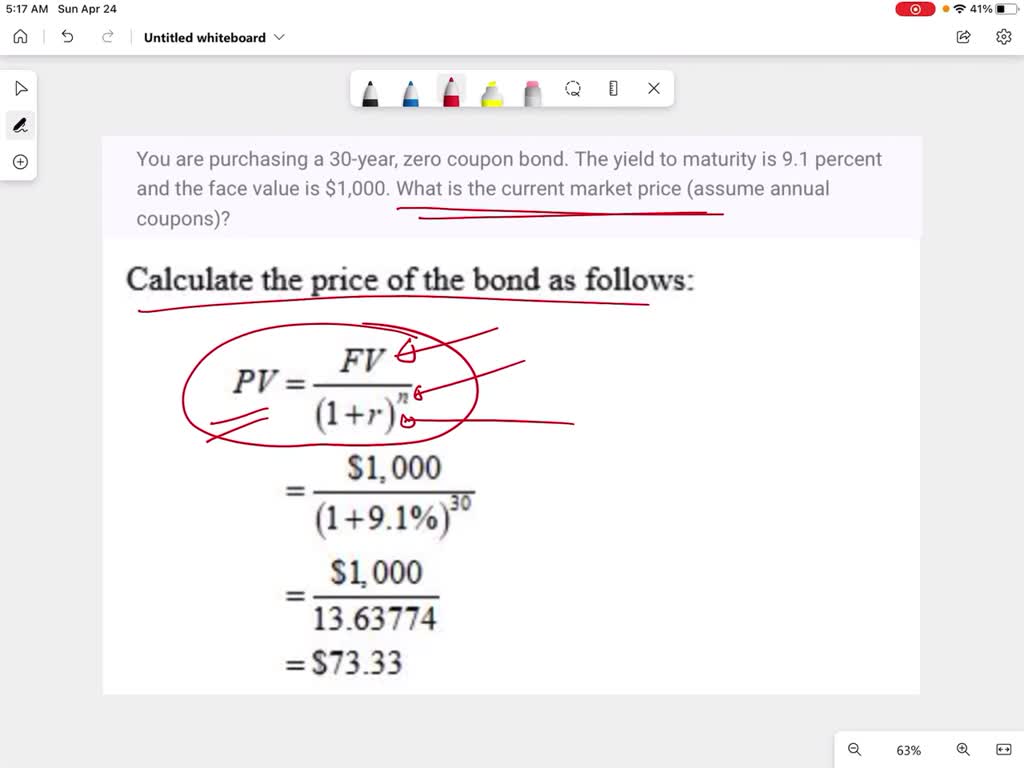

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Solved 15, A zero-coupon bond has a yield to maturity of 9% - Chegg Transcribed image text: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16.

Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter In the given formula, the numeral of zero (0) represents that there is no coupon yet. Face Value (F) Rate/Yield (r) Time to Maturity (t) = When the term zero-coupon bond comes, the two words urgently come into mind; one is the pure discount bond, and the other one is the discount bond. Both of these words represent the common zero coupon bond term.

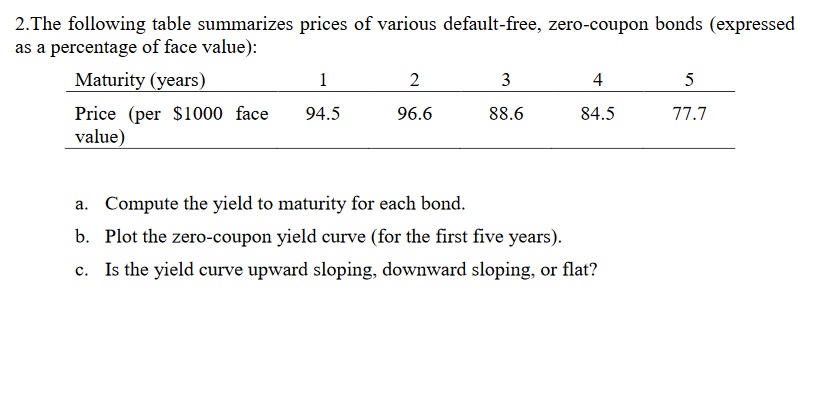

Question : The current yield curve for default-free zero-coupon bonds ... See the answer. The current yield curve for default-free zero-coupon bonds is as follows: Maturity (years) YTM. 1. 10. %. 2. 11.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ...

Yield to Maturity Calculator | Calculate YTM The yield to maturity calculator (YTM calculator) is a handy tool for finding the rate of return that an investor can expect on a bond. As this metric is one of the most significant factors that can impact the bond price, it is essential for an investor to fully understand the YTM definition. ... In our example, Bond A has a coupon rate of 5% ...

open source hwid spoofer - iel.okitei.info The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. The required yield to maturity is close to 6%. At 5.865% the price of the bond is INR 950.02. Hence, the estimated yield to maturity for this bond is 5.865%. Variations of Yield to Maturity (YTM) Yield to Call.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20.

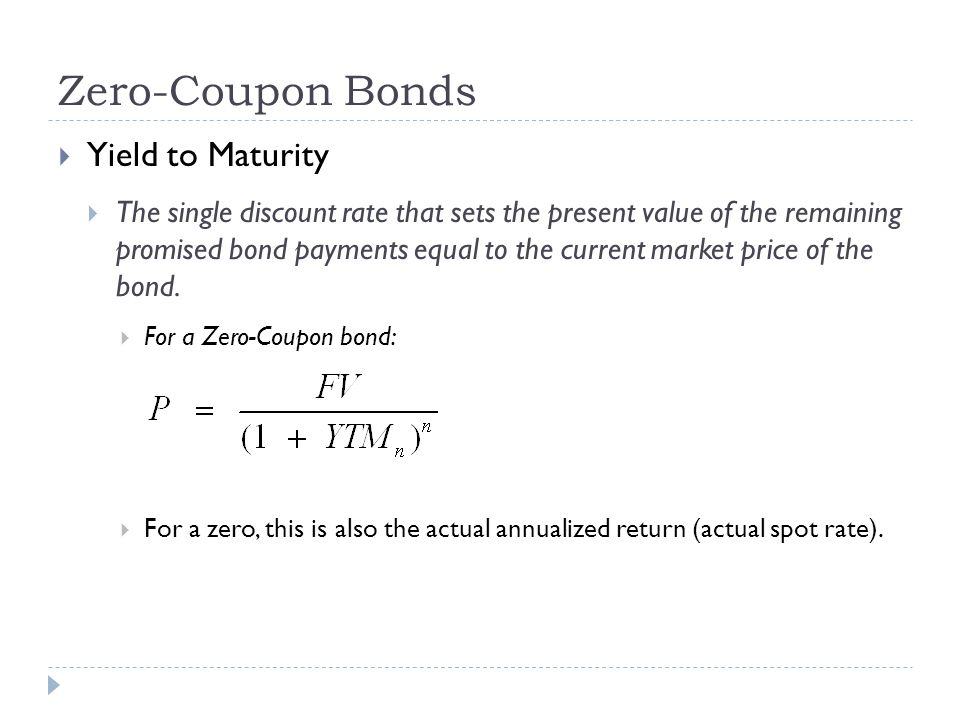

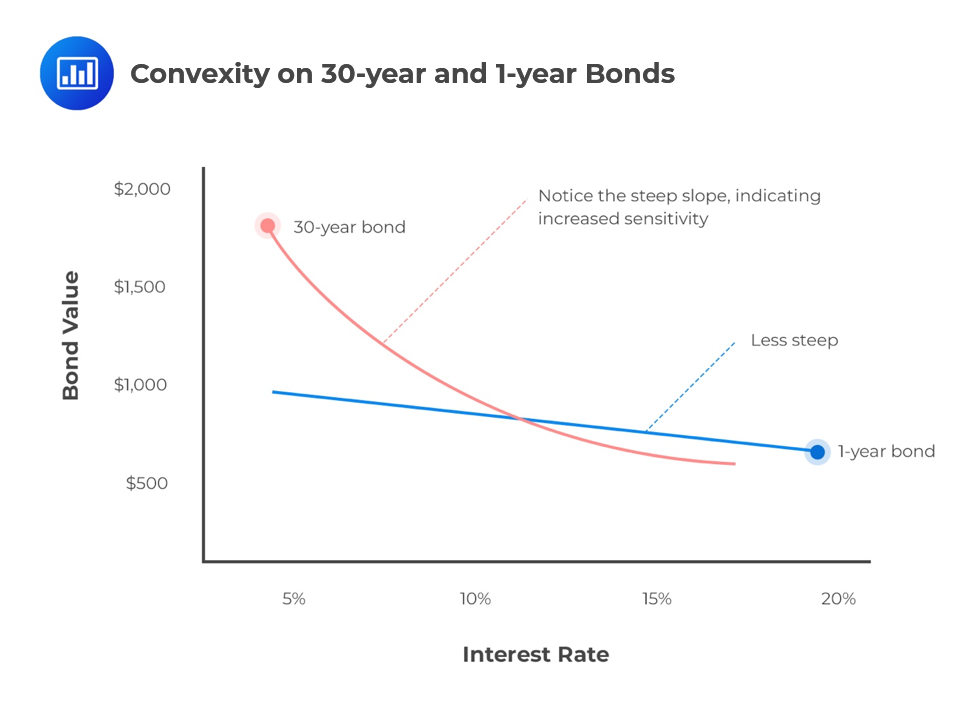

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "38 yield to maturity for zero coupon bond"